Click here and press the right key for the next slide.

(This may not work on mobile or ipad. You can try using chrome or firefox, but even that may fail. Sorry.)

also ...

Press the left key to go backwards (or swipe right)

Press n to toggle whether notes are shown (or add '?notes' to the url before the #)

Press m or double tap to slide thumbnails (menu)

Press ? at any time to show the keyboard shortcuts

Question Session 07

this is being recorded

Alex

Does pursuing the Nash equilibrium in the gangster game forces both gangsters in the least profitable option?

hawk-dove

| Gangster X | |||

| stay home | attack | ||

| Gangster Y | stay home | 2 2 | 1 3 |

| attack | 3 1 | 0 0 | |

mixed strategies

hawk-dove

| Gangster X | |||

| stay home | attack | ||

| Gangster Y | stay home | 2 2 | 1 3 |

| attack | 3 1 | 0 0 | |

Strategies: each player selects stay-home with .5 probability.

Expected payoff for X:

0.5 * (X’s payoff from stay home) = 0.5 * (0.5 * 2 + 0.5 * 1)

+

0.5 * (X’s payoff from attack) = 0.5 * (0.5 * 3 + 0.5 * 0)

= 1.5

Nash equilibrium for mixed strategies

hawk-dove

| Gangster X | |||

| stay home | attack | ||

| Gangster Y | stay home | 2 2 | 1 3 |

| attack | 3 1 | 0 0 | |

Strategies: each player selects stay-home with .5 probability.

Expected payoff for X:

0.5 * (X’s payoff from stay home) = 0.5 * (0.5 * 2 + 0.5 * 1)

+

0.5 * (X’s payoff from attack) = 0.5 * (0.5 * 3 + 0.5 * 0)

= 1.5

cardinal vs ordinal preferences

hawk-dove

| Gangster X | |||

| stay home | attack | ||

| Gangster Y | stay home | 2 2 | 1 3 |

| attack | 3 1 | 0 0 | |

the greater the benefit from attack

-> the more frequent the attacks (at Nash equilibrium)

-> the lower expected the payoff

game theory explains

Both twins would do better if they never fought ...

But if they never fought, one could do even better by attacking.

The mixed strategy Nash equilibrium predicts a relation

between the frequency of attacks and the value of rewards.

assumptions of game theory are false

objections to decision theory carry over

+

many applications of game theory assume common knowledge of rationality

Alex

Does pursuing the Nash equilibrium in the gangster game forces both gangsters in the least profitable option?

hawk-dove

| Gangster X | |||

| stay home | attack | ||

| Gangster Y | stay home | 2 2 | 1 3 |

| attack | 3 1 | 0 0 | |

another question

Identify any one putative objection to an assumption of decision theory.

Why might this objection also lead to an objection to Dickinson’s dual process theory of action?

Does it?

idea 1

1. The Objection (e.g. Ellsberg Paradox) shows that if we characterise preferences as decision theoretic constructs, few if any people actually have preferences.

2. There is no way to characterise preferences except as decision theoretic constructs.

3. Therefore there is no way to characterise goal-directed processes

‘Preferring a dominated option or expressing different preferences depending on the framing of options . . . demonstrate[s] . . . the absence of stable preferences and resulting irrational decisions’

(Simonson, 2015, p. 20)

‘Imagine you are about tu purchase a jacket for $125 $15 and a calculator for $125 $15.

‘The calculator salesman informs you that the calculator you wish to buyis on sale for $120 $10 at the other branch of the store located 20 minutes drive away.

Would you make the trip to the other store?

(Tversky & Kahneman, 1981, p. 212)

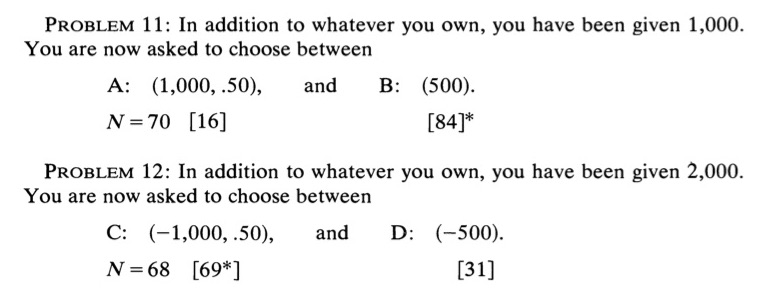

another example of framing effects

(Kahneman & Tversky, 2012, p. 272)

‘Preferring a dominated option or expressing different preferences depending on the framing of options . . . demonstrate[s] . . . the absence of stable preferences and resulting irrational decisions’

(Simonson, 2015, p. 20)

idea 1

1. The Objection (e.g. Ellsberg Paradox) shows that if we characterise preferences as decision theoretic constructs, few if any people actually have preferences.

2. There is no way to characterise preferences except as decision theoretic constructs.

3. Therefore there is no way to characterise goal-directed processes

‘The problem with measuring risk preferences is not that measurement is difficult and inaccurate; it is that there are no risk preferences to measure---there is simply no answer to how, ‘deep down’, we wish to balance risk and reward.

And, while we’re at it, the same goes for the way people trade off present against future; how altruistic we are and to whom; how far we display prejudice on gender, race, and so on ...

there is no point wondering which way of asking the question [...] will tell us what people really want.

there can be no method...that can conceivably answer this question, not because our mental motives, desires and preferences are impenetrable, but because they don’t exist’

(Chater, 2018, pp. 123--4)

idea 1

1. The Objection (e.g. Ellsberg Paradox) shows that if we characterise preferences as decision theoretic constructs, few if any people actually have preferences.

2. There is no way to characterise preferences except as decision theoretic constructs.

3. Therefore there is no way to characterise goal-directed processes

‘Expected utility theory [...] has come under serious question [...]

There is now general agreement that the theory does not provide an adequate description of individual choice: a substantial body of evidence shows that decision makers systematically violate its basic tenets.

Many alternative models have been proposed’

(Tversky & Kahneman, 1992, p. 297)

idea 1

1. The Objection (e.g. Ellsberg Paradox) shows that if we characterise preferences as decision theoretic constructs, few if any people actually have preferences.

2. There is no way to characterise preferences except as decision theoretic constructs.

3. Therefore there is no way to characterise goal-directed processes

Identify any one putative objection to an assumption of decision theory.

Why might this objection also lead to an objection to Dickinson’s dual process theory of action?

Does it?

more questions?